In the context of Vietnam's rapidly growing economy, the labor trends in the country are also shifting with many notable changes. Advanced industries such as electronic components and semiconductors are attracting significant attention from both domestic and foreign companies. This creates a high demand for highly skilled personnel. Additionally, the model of domestic labor export is increasingly seen as a strategic solution to address workforce supply challenges and improve skills for workers.

1. Domestic Labor Export as a New Solution for the Labor Market

Domestic labor export is a relatively new concept that is gaining popularity in Vietnam. Unlike traditional labor export, which focuses on sending workers abroad, domestic labor export involves relocating labor from regions with surplus manpower to areas with labor shortages within the country. This is considered an effective solution to balance labor supply and demand across regions, while also providing workers with additional opportunities to work and develop skills in their homeland.

The development of domestic labor export not only helps workers save on travel and living costs but also allows them to access new professions and enhance their technical skills. Additionally, this model helps businesses in labor-short areas quickly and effectively resolve their staffing challenges.

2. The Electronic Components and Semiconductor Industries: Labor Market Growth

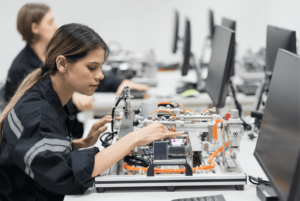

The two industries currently experiencing the highest demand for labor are electronic components and semiconductors. With increased investment from major technology companies, Vietnam is becoming one of the attractive destinations for companies producing electronic components and semiconductors. This trend drives the need for skilled technical personnel, requiring workers to receive formal training and possess good professional skills.

Foreign direct investment (FDI) in Vietnam has shown impressive growth, exceeding 32.1% compared to 2022, primarily due to the attraction of new projects, reflecting a shift in the foreign investment environment in Vietnam.

As of September 30, the total registered capital for new, adjusted, and contributed foreign investments reached over 24.78 billion USD, an increase of 11.6% compared to the same period in 2023. Moreover, the actual implementation of foreign investment projects is estimated at over 17.3 billion USD, up 8.9% from the same time last year.

In September alone, total FDI capital reached its highest level for the year so far, at nearly 4.26 billion USD, accounting for 17.2% of the total investment in the country for the first nine months. The additional investment capital also reached its highest level for the year, with significant capital expansion projects.

As of September, there are 41,314 effective FDI projects in the country with a total registered capital of nearly 491.71 billion USD. The cumulative actual capital of FDI projects is estimated at around 314.5 billion USD, accounting for nearly 64% of the total effective registered investment.

With this significant investment wave flowing into Vietnam, many believe that the country is at an important crossroads, with opportunities arising from major shifts in global supply chains.

The electronic components industry is currently thriving due to the global supply chain shift, as many foreign companies choose Vietnam as a production and assembly hub for technology products. Additionally, the semiconductor sector is gradually asserting its importance as major corporations ramp up investments in semiconductor chip production in Vietnam. This opens up significant job opportunities for domestic labor, especially for those with technical skills and high expertise.

However, many investors, both domestic and foreign, have expressed concerns about the local shortage of skilled labor needed to recover and expand production and business operations, particularly in industries requiring high-quality labor to apply new technologies and increase productivity. Many argue that FDI inflows into Vietnam could decline significantly if there is no timely improvement in training quality, risking a setback in the labor force and losing the advantage of low labor costs.

3. Workforce Supply and Vocational Training: GLA HR's Breakthrough

To meet the increasing labor demands of advanced industries, workforce supply and vocational training play a crucial role. GLA HR is one of the pioneering companies providing workforce solutions and vocational training for major domestic and international businesses. With a professional operating philosophy, GLA HR not only focuses on supplying labor but also emphasizes skill development for workers, helping them meet the stringent requirements of the modern labor market.

GLA HR understands that for workers to realize their full potential, training and skill development are key factors. Therefore, GLA HR has established several in-depth vocational training programs targeted at key industries like electronic components and semiconductors. These programs focus not only on technical skills but also on enhancing soft skills, enabling workers to be confident and proactive in their jobs.

The labor trends in Vietnam are undergoing significant changes, with a strong shift from traditional industries to new, advanced sectors. Domestic labor export is an innovative solution that helps balance labor supply and demand, while industries like electronic components and semiconductors are opening up vast opportunities for local workers. Moreover, workforce supply and vocational training from reputable providers like GLA HR will be crucial to ensuring a quality labor force that meets the demands of a highly competitive labor market.

Join our Zalo group for HOT JOB opportunities: https://zalo.me/g/osiedw964